Services

Financial Advising/ Debt Advisory

Services

Financial Advising/ Debt Advisory

Services

Financial Advising/ Debt Advisory

Services

Financial Advising/ Debt Advisory

Services

Financial Advising/ Debt Advisory

Services

Financial Advising/ Debt Advisory

Discretion

With so much on the line, you can’t afford to go without them.

Preparation

More intense preparation for meetings with banks

Thinking like banks

Better understanding market standards

Network

Exploiting our contacts in the finance sector

Services

Debt Advisory - Financing Strategy, Recapitalisation and Restructuring

Your company moves considerable sums of money, which you, like most medium-sized companies, pre-finance in the form of loans. Perhaps your company is set to undergo restructuring or you want to set aside investments aimed at future viability or for prospective growth projects.

You appreciate how important it is to keep an eye on -- and continuously reassess -- your financing structure and the terms involved. Because your banks are doing the same thing.

So you understand how important it can be to develop a new financing strategy, one that can generate competition between banks or to break up a bank pool.

If you’re seeking assistance - especially during difficult periods - we’re there for you. We understand how banks think and are familiar with their documentation requirements. We are acquainted with the market standards that affect you and can help you structure complex financing from a variety of financial instruments.

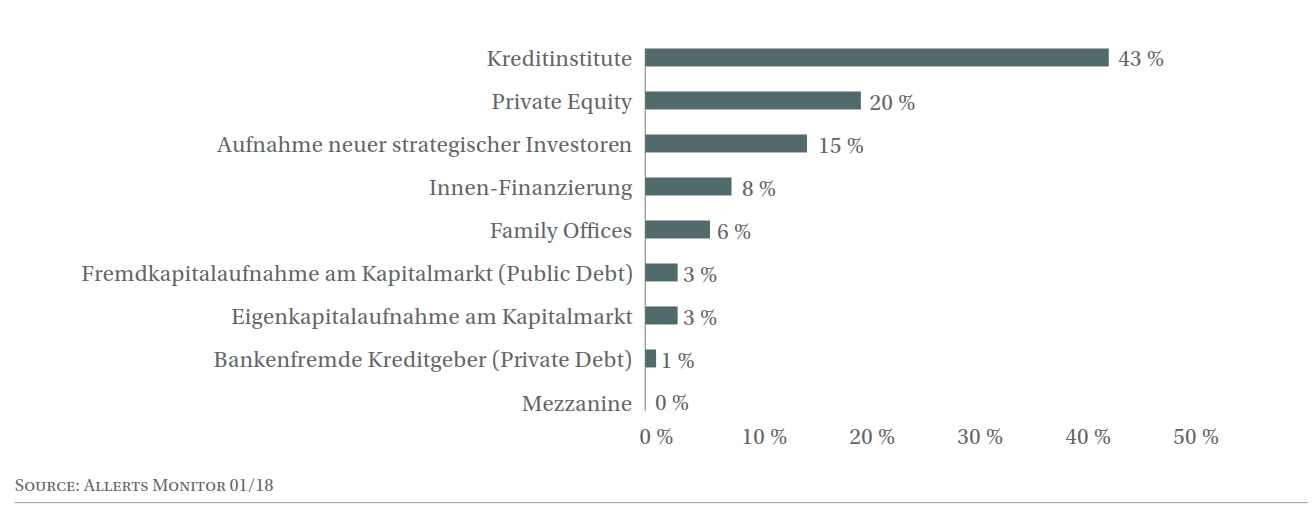

- Alternative Forms of Financing

- Mezzanine

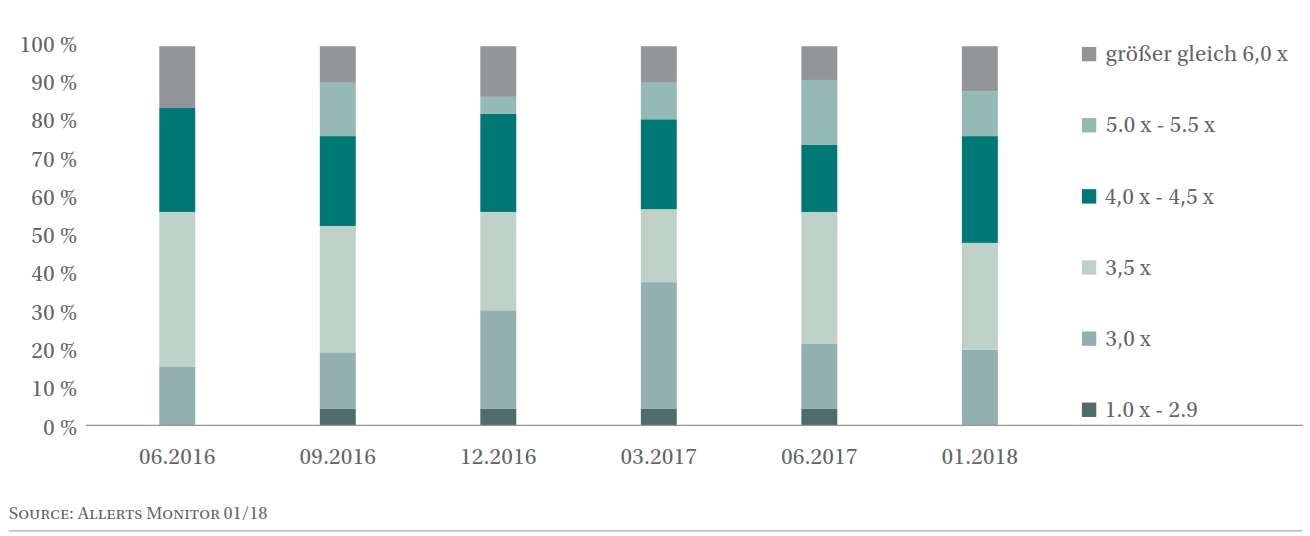

- Financial Covenants

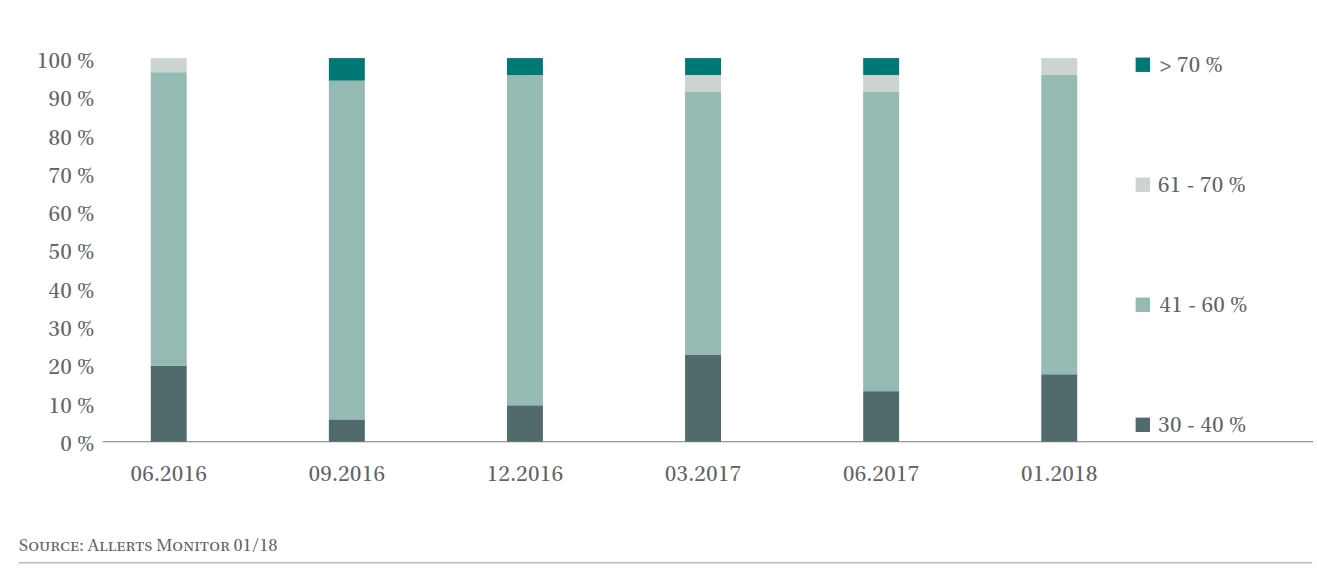

- Load Security

- Analysis of debt capacity

- LBO Analysis

- Asset-Based Financing