Services

Enterprise Valuation/ Financial Modelling

Services

Enterprise Valuation/ Financial Modelling

Services

Enterprise Valuation/ Financial Modelling

Services

Enterprise Valuation/ Financial Modelling

Correct Models

Legitimate and correct valuation models generate acceptance

Transparency

Whatever seems logical and reasonable to some will prove persuasive for others

Applicability

The only thing that makes sense is what is actually feasible

Simplicity

Avoid complexity - wherever possible

Services

Turning figures into value

At the end of the day, every entrepreneurial activity is reflected in the figures. And these figures have to be understandable and transparent not only to you but also to your business partners, investors and, most importantly, to potential investors.

With the help of clearly understandable financial models, indicative valuations, analyses, factbooks and even expert assessments, we have shown mid-sized companies how to go about providing both themselves and their counterparts with greater transparency regarding their situation, old and new business models and the value of their company. We depict uncertainties in business in scenarios and through risk simulation procedures.

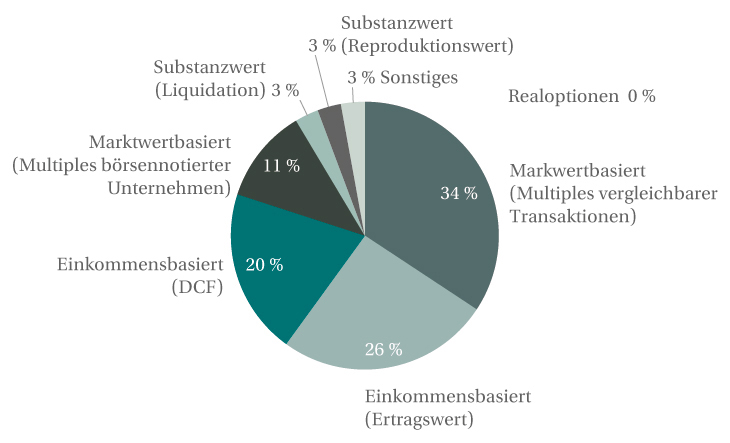

We evaluate companies in accordance with all common and accepted valuation methods and create as a basis for this a financing model that the client can easily understand and that serves as a solid basis of argumentation vis-á-vis a transaction partner. This can function as an instrument for your own decision-making as well as for risk management.

- Integrated Finance Models

- Earnings Approach per IDW S 1

- Discounted Cash Flow Process

- Multiplier process (Price determination using multiples)

- Expert opinion on appropriateness of transaction prices/fairness opinion

- Leveraged buy-out analyses

- Valuation of companies facing financial difficulties

- Valuation of young companies

- Valuation of immaterial assets and unused assets

- Valuation that takes into account uncertainties (Monte Carlo simulations)

- Real options analyses